What’s Covered in a Water Damage Insurance Claim?

Water damage is brutal. It can ruin both your home and your belongings. It can leave behind mold, an even more destructive force.

And if you’re not mitigating your water damage risk because you think insurance will cover everything, you may be in for a rude awakening.

Insurance is for emergencies.

Homeowner’s insurance typically covers things like tree limbs falling and tearing a hole in your roof, or tornadoes ripping the shingles away. It doesn’t cover basic maintenance failures, or even, always, the results of those maintenance failures.

“If the damage is not sudden or accidental, but instead is the result of a long-standing problem that went undetected, you will have a problem from the claim and might have a claim denied.” – The Balance

Clogged, leaky, or broken gutters would definitely count as a long-standing problem. And if you get a roof leak because of this problem homeowner’s insurance isn’t going to cover that.

Standing water and mold aren’t covered without separate policies.

Any standing water would fall under your flood policy. And on most policies you need a separate rider for mold damage and remediation.

If this is a concern, it’s a good idea to contact your insurance agent about it now, before there’s any problem in the home. That way you can add these coverages to your account and have the peace of mind that comes with doing so.

Keeping your gutters clear is its own form of insurance.

Think about this: whenever you file a claim, your insurance bill goes up.

Meanwhile, if you improve your gutters, add Flo-Free leaf guards to keep them clean, and make them seamless to avoid leaks, you’re stopping exactly the kinds of damages insurance won’t handle.

This means your rates stay stable, which means your gutters pay for themselves. And if you do get storm damage, a burst pipe, or any other type of damage which you might need insurance for you can prove you did what you needed to do to maintain the home.

It will also cost significantly less than you probably think it’s going to cost. That’s a theme that comes up in our reviews time and time again.

Gutters and insurance aren’t the most glamorous topics in the world.

But they’re both absolutely necessary if you want to have a glamorous home, one that stays in good repair and is as covered against disaster as it is possible to get.

The post What’s Covered in a Water Damage Insurance Claim? appeared first on Rain Control Gutters.

Local Family Owned and Operated

OUR SERVICE AREA:

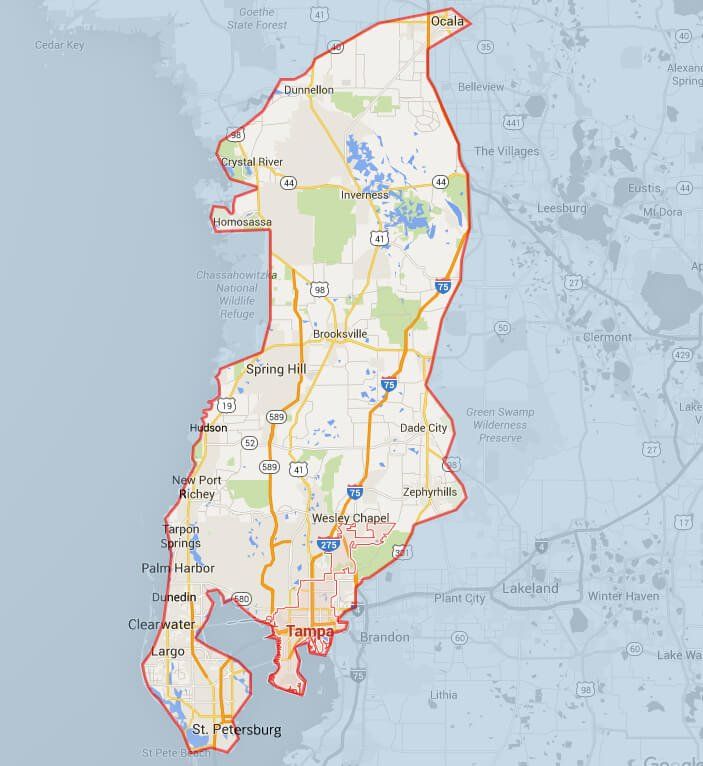

We serve Hillsborough County, Hernando County, Pasco County, Pinellas County and Citrus County of Central Florida

Including but not limited to: Brooksville, Carrollwood, Cheval, Citrus Park, Clearwater, Dade City, Dunedin, Holiday, Homosassa, Hudson, Inverness, Land O Lakes, Largo, Lutz, New Port Richey, Northdale, Odessa, Oldsmar, Palm Harbor, Safety Harbor, Spring Hill, St. Petersburg, Tampa, Tarpon Springs, Trinity, Wesley Chapel, Westchase, Zephyrhills and more.

If you do not see your city or town please call to see if you are in our service area.

Licensed and Insured

Hillsborough County License # SP14612 | Hernando County License # AAA0052197 | Pasco County License # SAC-09777 | Pinellas County License # C-11408

Rain Control Gutters is a Florida Registered Name associated with its owner, Rain Control of Central Florida, LLC

Corporate Office

Spring Hill Office

All Rights Reserved | Rain Control Gutters | Website By RedoSites