Will Storm Damage Insurance Claims Raise Your Rates?

In our service area (including St. Petersburg, Largo, Clearwater and the rest of the Tampa Bay area) storm season is right on the horizon. And since it is, we thought we would take a moment to talk about the effect that filing a storm damage claim has on your homeowner’s insurance rates.

In our service area (including St. Petersburg, Largo, Clearwater and the rest of the Tampa Bay area) storm season is right on the horizon. And since it is, we thought we would take a moment to talk about the effect that filing a storm damage claim has on your homeowner’s insurance rates.

Why? Because we’ve had clients who were reluctant to have damage to their gutters or other parts of their house fixed. They couldn’t necessarily foot the bill on their own, but they didn’t want to reach out to their homeowner’s insurance companies because they feared a rate increase, or being dropped altogether.

So we looked into the issue, and we found good news.

Homeowner’s insurance isn’t like car insurance. With car insurance, your premiums are almost guaranteed to go up just about any time you file a claim.

Most homeowner’s insurance policies, however, make provisions for “acts of God.” That is, they know that there isn’t much you can do to mitigate the risk of a storm yourself (other than deciding not to live in Florida at all, in which case, they wouldn’t have your business).

Making a storm damage claim, especially a single storm damage claim, usually won’t raise your rates at all. And, if you think about it, when you do make a storm damage claim you’re probably not alone. Many other homeowners in your zip code are probably doing the same thing.

Before you file a claim, it’s always a good idea to call your insurance company and ask if your claim would have any negative repercussions on your rates. If your insurance policy does have the “acts of God” provision, then you’ll like be fine.

Keep in mind, making two or more claims too close together will raise your rates, especially for things like dog bites or slip-and-fall issues. Again, it’s best to check with your individual insurance company to find out what will happen before you file any claims.

And, as we’ve already covered, in spite of the fact that they are beyond most people’s control, sinkholes are not treated like an act of God in Florida. A sinkhole claim can raise your rates or even cause your insurance company to drop you.

Every claim that you make is also included in the Comprehensive Loss Underwriting Exchange (CLUE). This is a national homeowner’s insurance database. Your rating in the CLUE database is used alongside your credit rating to determine your rates.

So while you shouldn’t hesitate to file a claim for major storm damage you might want to be more careful about filing other types of claims. One good rule of thumb would be to avoid filing any claim that will cost less than three times your deductible to fix.

Once you feel comfortable filing a claim, it’s best to get contractors out for a free estimate on anything that’s damaged, document everything with pictures, and be ready with hard numbers of your own. Adjusters are notorious for low-ball offers, and it’s important to get the damage to your home fixed and done right the first time!

Local Family Owned and Operated

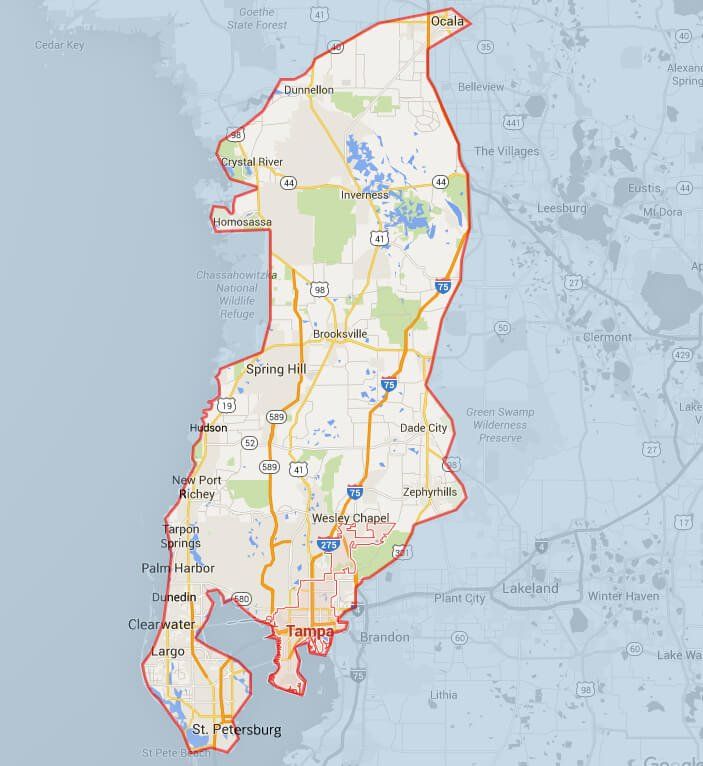

OUR SERVICE AREA:

We serve Hillsborough County, Hernando County, Pasco County, Pinellas County and Citrus County of Central Florida

Including but not limited to: Brooksville, Carrollwood, Cheval, Citrus Park, Clearwater, Dade City, Dunedin, Holiday, Homosassa, Hudson, Inverness, Land O Lakes, Largo, Lutz, New Port Richey, Northdale, Odessa, Oldsmar, Palm Harbor, Safety Harbor, Spring Hill, St. Petersburg, Tampa, Tarpon Springs, Trinity, Wesley Chapel, Westchase, Zephyrhills and more.

If you do not see your city or town please call to see if you are in our service area.

Licensed and Insured

Hillsborough County License # SP14612 | Hernando County License # AAA0052197 | Pasco County License # SAC-09777 | Pinellas County License # C-11408

Rain Control Gutters is a Florida Registered Name associated with its owner, Rain Control of Central Florida, LLC

Corporate Office

Spring Hill Office

All Rights Reserved | Rain Control Gutters | Website By RedoSites